Monzo Cash Deposit

See full list on monzo.com. Why there's a cash deposit limit. Criminals can use cash deposits for money laundering. We’ve done a few things to mitigate this already, but adding a deposit limit helps to reduce that risk even more.

Coronavirus help and support.Find out moreSpend, save and manage your money, all in one place. Open a full UK bank account from your phone, for free.

Join the people with a Monzo bank account

Monzo Premium: Banking that makes a statement

Turn heads with our white metal card, made from steel. Enjoy peace of mind with extensive phone and travel insurance, interest and much more.

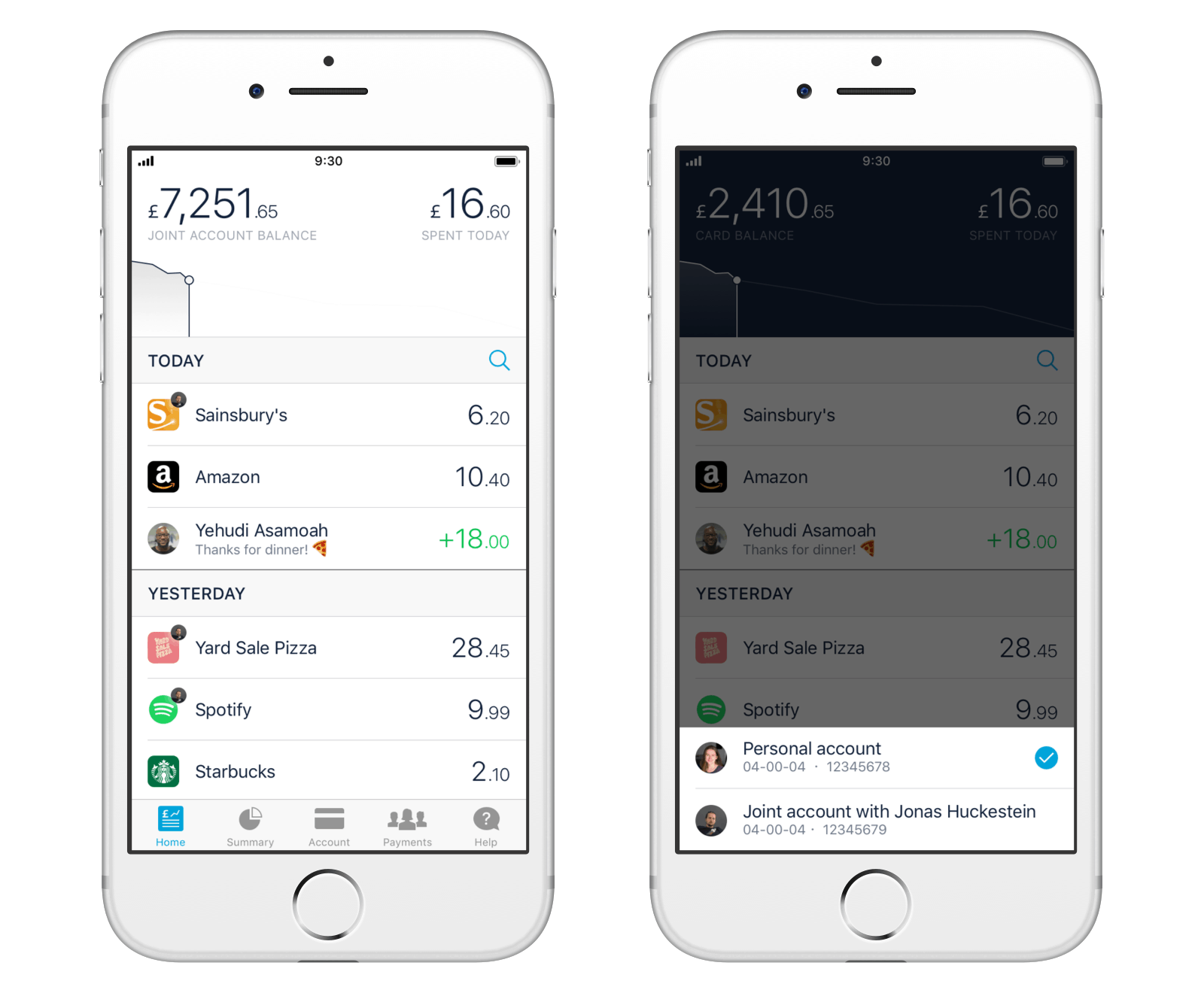

Monzo Plus Put money in your hands

Full financial visibility, with your other bank accounts and credit cards all in one place. Get interest on your money, personalised budgeting and much more.

Manage with Monzo

Pay Direct Debits through Monzo and we’ll tell you if they’re higher for the upcoming month. So no nasty surprises.

Spend with Monzo

Get instant notifications the second you pay. Set budgets for things like groceries and going out, and get warnings if you’re spending too fast (if you want them).

Travel with Monzo

Use Monzo anywhere in the world that accepts Mastercard. We don’t charge any fees for spending abroad, and we don’t mark up the exchange rate – unlike most other banks.

Monzo Cash Deposit Near Me

Borrow with Monzo

We offer overdrafts up to £1,000 and loans up to £3,000. Checking if you're eligible won't leave a mark on your credit score, there are no lengthy forms to fill in, and no charges for paying us back early.

Stay Safe with Monzo

Your money in Monzo is FSCS protected up to £85,000. Compared to other UK banks, we’re 4x better at stopping card fraud, and 3x better at stopping identity theft.

Independent service quality survey results

Personal current accounts

Published February 2021

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1000 customers of each of the 17 largest personal current account providers if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.

Help us build the kind of bank you want to use

Download the Monzo app on iOS or Android and join the people who've changed the way they bank.

Monzo’s latest annual report shows its losses after tax reached £113.8m in 2019-20 – more than double the year before.

This is despite the fact that more than four million people now have a Monzo account, with Current Account Switch Service (CASS) figures showing it had the highest net switching gains of any other UK bank in that year.

Monzo says the coronavirus pandemic is continuing to make a ‘significant impact’ on the business, which has already made 120 redundancies in its UK head office earlier this year.

But is this something Monzo current account and savings account customers need to worry about?

Here, Which? looks at the challenges faced by banks like Monzo and what you need to do to keep your money safe.

Should I be worried about my Monzo account?

What Is Cash Deposit

In short, no. It’s important to note that Monzo is in no immediate financial danger and it is continuing to function as normal.

While the bank’s losses for 2019-20 are significant, it puts them down to increased investments.

It may be that new products will be able to turn the losses around. Just last month we saw the launch of new premium account Monzo Plus, which costs £5 a month, and there are hints that further paid-for products are in the pipeline.

Monzo has also been preparing for future coronavirus-related losses. Its annual report asserts that it has enough ‘High Quality Liquid Assets’ – that is, investments that can be quickly and easily converted into cash – to cover all of its customers’ deposits.

However, should the worst happen and Monzo goes bust, deposits of up to £85,000 (or up to £1m in certain circumstances, see below) will be covered by the Financial Services Compensation Scheme (FSCS).

- Find out more:best and worst banks

How to ensure your Monzo money is protected by the FSCS

If a UK bank, building society or credit union goes bust, the FSCS will cover up to £85,000 held in deposit accounts. That’s per person, per banking institution – not per bank.

If you have a large amount of money in your current account and savings, it’s good practice to split this across more than one banking institution to make sure you don’t exceed the limit.

For instance, if you had £50,000 saved with Halifax and £50,000 saved with Bank of Scotland – which are both a part of Lloyds Banking Group – you’d be in danger of losing £15,000 if the group were to go bust, as the savings would exceed the FSCS protection limit.

However, splitting your savings between, say, Halifax and Santander would mean all of your money is covered, as the banks belong to different banking institutions.

Monzo offers a current account, joint account, premium account, pots and savings accounts. If you have a total of more than £85,000 held across these accounts, it’s best to transfer some of this cash elsewhere so that it does not exceed the limit covered by the FSCS.

It’s worth taking extra care if you have a Monzo savings account that’s offered through a partnership with other savings providers, including OakNorth Bank, Charter Savings Bank and Paragon. If you had a Monzo savings pot that’s provided by, say, OakNorth Bank, and a separate account that you opened directly with OakNorth Bank, then the deposits held in both of those accounts would count towards the limit of £85,000.

- Find out more:The FSCS – are my savings safe?

The ‘temporary high balances’ exception

In some circumstances you could be covered for holding more than £85,000 in your bank account under the FSCS, but for a limited time and in certain circumstances.

There’s a measure to protect some types of ‘temporary high balances’ (THB) worth up to £1m, where certain life events mean you have more money in your account the normal. This may be the result of a house sale, redundancy payment or inheritance, for example.

Originally the THB protection only lasted six months, but from 6 August the Prudential Regulatory Authority (PRA) is temporarily extending the THB timeframe to 12 months. The move is in recognition that some people have had reduced access to banking services, and that due to the impact of COVID-19 there could be more people with large balances who need a longer period of protection.

In any case, you will need to prove the balance meets the criteria of a THB and provide evidence in order to make a claim.

The FSCS also covers mortgages, insurance and investments, but the terms and compensation amounts vary depending on the type of product you take out.

How is COVID-19 affecting banks?

Monzo Cash Deposit Bonus

As with much of the UK economy, the full effects of the coronavirus crisis aren’t fully understood yet, but banks face several challenges from the fallout. A few of these include:

Monzo Cash Deposit Limit

- Payment holidays In April the FCA announced all lenders must offer payment holidays for mortgages, overdrafts, personal loans, credit cards, motor finance and high-cost credit, in a bid to help those whose finances were affected by COVID-19. This has meant banks have had months of reduced income; Monzo’s annual statement revealed it had granted 811 loan payment holidays in 2020-21.

- Loan losses When the mandatory payment holidays finish at the end of October, there are likely to be a significant number of people who are still unable to pay what they owe. This means lenders may miss out significant amounts of money they had loaned out.

- Tentative spending Even those who aren’t in financial difficulty may pose problems for banks, as uncertainty about the future could put people off spending as they did pre-pandemic, meaning a reduction in ‘good’ loans.

- Reduced switching The latest Current Account Switch Service figures showed a 65% fall in the number of bank account switches between April and June of this year, which means banks are finding it hard to get new customers. Halifax recently launched a £100 switching bonus in a bid to tempt people back into moving.

Read the latest coronavirus news and advice from Which?