Chime Deposit

- Chime Deposit Limit

- Chime Deposit Fee

- Chime Deposit Account

- Chime Deposit Locations

- Chime Deposit Fees

- Chime Deposit Account

| Type | Private |

|---|---|

| Industry | Financial services |

| Founded | 2013; 8 years ago |

| Founders | Chris Britt Ryan King |

| Headquarters | San Francisco, California, United States |

| Products | Checking accounts, savings accounts, debit cards, p2p, fee-free overdraft |

| Revenue | US$200 million (2019)[1] |

| Total assets | US$5.8 billion (2019)[1] |

| Website | chime.com |

Chime does not accept deposits of any kind from an ATM. You can deposit cash to your Chime Spending Account at over 90,000 retail locations (like Walmart, Walgreens, and 7-Eleven): Ask the cashier to.

- Time from sent till received: Instant. As we covered in our guide to adding money to.

- Chime - $75 (direct deposit). Citibank - $300-$1,500 ($15,000+ funding). HSBC Bank - $50-$450 (direct deposit). Lili - $25 (debit card). MAJORITY - $60 ($10 funding/direct deposit). NorthOne - $75 ($50 funding). One Finance - $50 ($250 direct deposit). Oxygen - $25 ($200 funding & debit card). Porte - $50 (direct deposit/ACH). Radius Bank - $50.

- To find a cash deposit partner near you, go to the app, tap Move Money, select Deposit cash, and tap See locations near me. At the retail location, ask the cashier to make a deposit to your Chime Spending Account. You can make up to 3 deposits every 24 hours. You can add up to $1,000.00 every 24 hours for a maximum of $10,000.00 every month.

Chime is an American technology neobank company which provides fee-free financial services through a mobile app. Chime has no physical branches and does not charge monthly or overdraft fees. As of February 2020, Chime had 8 million account holders.[2] Account-holders are issued Visadebit cards and have access to an online banking system accessible through chime.com or via the mobile app for Android or iOS. Chime earns the majority of its revenue from the collection of interchange.[3][4]

Chime Deposit Limit

Chime bank accounts are insured up to the standard maximum deposit insurance amount of $250,000 through its partners, The Bancorp Bank or Central National Bank, which rebranded itself as Stride Bank, N.A. in 2019.[5][6] Accounts are also owned and managed by either The Bancorp Bank or Stride Bank.

History

Chime was founded by Chris Britt (CEO) and Ryan King (CTO) in 2013 in San Francisco, California as an alternative to traditional banking. The company launched publicly on April 15, 2014 on the Dr. Phil Show.[7] As of 2020, Chime has raised $1.5 billion in private funding.[8]

Chime Deposit Fee

In 2018, Chime acquired Pinch, a startup focused on helping millennials and young adults build their credit scores by reporting on-time rent payments to credit bureaus. Pinch's co-founders joined Chime's team as a part of the acquisition.[9]

On October 16, 2019, Chime experienced a service outage leaving users without access to their deposits. The issue was resolved the next day. [10]

In January 2020, Chime announced a partnership with the Dallas Mavericks as their jersey sponsor as a part of a multi-year deal.[11]

Response to the COVID-19 pandemic

In April 2020, in response to the financial strain of the COVID-19 pandemic, Chime announced a pilot program to provide users who e-filed tax returns with the IRS a $1,200 advance on the Economic Stimulus Payment via SpotMe, Chime's fee-free overdraft product. [12] Chime later announced the successful processing of over $375,000,000 in stimulus payments 1 week ahead of the scheduled government disbursement date.[13]

Products

Chime offers various fee-free banking products, including checking accounts with no minimum balance, an automated savings feature, and early wage access.[14]

In September 2019, Chime launched SpotMe, a fee-free overdraft service where customers can overdraw their accounts up to $100 without incurring an overdraft fee; once the overdraft limit is reached, purchases will be declined but no traditional negative balance fees charged.[15]

Chime launched Credit Builder in June 2020, a credit card designed to help consumers build their credit history.[16]

See also

References

- ^ abFuscaldo, Donna. 'Digital Bank Chime Now Has a Valuation of $5.8 Billion'. Forbes.

- ^Magana, Gregory. 'Chime has hit 8 million accounts and is now offering a 1.6% interest rate on savings products'. Business Insider.

- ^'Online bank Chime is said to near funding at $1.5 billion value'. American Banker. Retrieved 2019-12-08.

- ^'Chime'. Growjo. Retrieved 19 November 2020.

- ^'Home'. stridebank.com. Retrieved 2020-07-29.

- ^'What type of account is my Chime account?'. Chime Banking - Help Center. Retrieved 2020-07-29.

- ^McGraw, Phil (April 15, 2014). 'Dr. Phil Surprises a Guest Preparing for a New Baby'. YouTube.

- ^'Chime is now worth $14.5 billion, surging past Robinhood as the most valuable US consumer fintechs'. CNBC. Retrieved 2020-11-01.

- ^'Mobile bank Chime picks up credit score improvement service Pinch in all-stock deal'.

- ^Son, Hugh; Rooney, Kate (October 17, 2019). 'Mobile bank Chime goes dark for millions of customers as it seeks $5 billion valuation'. CNBC.

- ^Rader, Doyle. 'Dallas Mavericks Announce Multi-Year Partnership With Chime As Jersey Sponsor'. Forbes.

- ^Son, Hugh (April 2, 2020). 'Chime pilots way to get $1,200 stimulus checks to users instantly after talks with Mark Cuban'. CNBC.

- ^'#ChimeCARES Update: Initial stimulus payments have been received. More on the way. Chime'. Banking Made Awesome. April 10, 2020.

- ^Green, Rachel. 'Chime's recent earnings marks the largest single equity investment in a neobank'. Business Insider.

- ^'Chime now has 5 million customers and introduces overdraft alternative'.

- ^'US challenger bank Chime launches Credit Builder, a credit card that works more like debit'. Techcrunch.

Fee-free overdraft up to $100.¹ Get paid up to 2 days early with direct deposit.² Grow your savings.

Learn how we collect and use your information by visiting our Privacy Policy›

The Bancorp Bank or Stride Bank, N.A.; Members FDIC

Overdraft fee-free with SpotMe

We’ll spot you up to $100 on debit card purchases with no overdraft fees. Eligibility requirements apply.¹

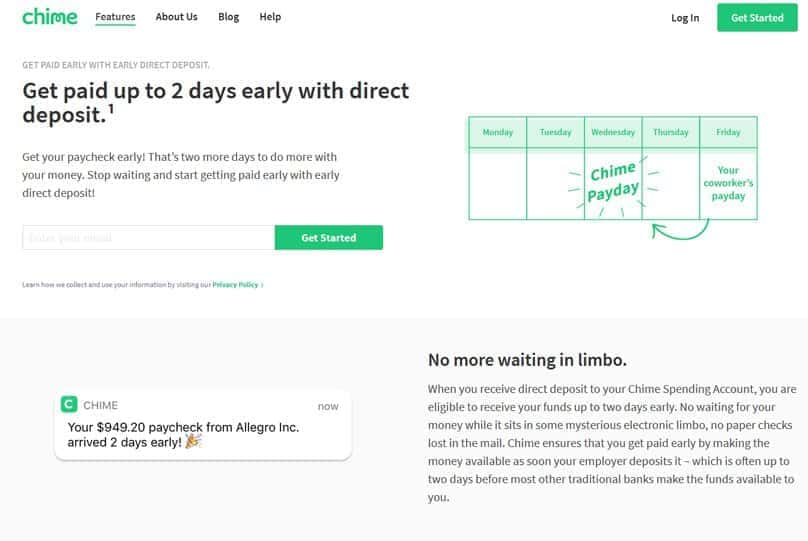

Get paid early

Set up direct deposit and get your paycheck up to 2 days earlier than some of your co-workers!²

Say goodbye to hidden fees³

No overdraft. No minimum balance. No monthly fees. No foreign transaction fees. 38,000+ fee-free MoneyPass® and Visa Plus Alliance ATMs. Out-of-network fees apply.

Make your money grow fast

0.50% Annual Percentage Yield (APY)⁴. Set money aside with Automatic Savings features. And never pay a fee on your Savings Account.

Stay in control with alerts

You’re always in-the-know with daily balance notifications and transaction alerts

Chime Deposit Account

Security & support you can trust

Chime Deposit Locations

Serious security

Chime uses secure processes to protect your information and help prevent unauthorized use

Privacy and protection

Your deposits are FDIC insured up to $250,000 through The Bancorp Bank or Stride Bank N.A.; Members FDIC

Chime Deposit Fees

Friendly support

Chime Deposit Account

Have questions? Send a message to our Member Services team in the app or check out the Help Center.

Get started

Applying for an account is free and takes less than 2 minutes.

It won’t affect your credit score!

Learn how we collect and use your information by visiting our Privacy Policy›