Bank Of America Mobile Deposit

How to deposit checks with our Mobile Banking app. Open the app, use your fingerprint to securely sign in Footnote 3 and select Deposit Checks. Sign the back of the check and write “for deposit only at Bank of America”. Take photos of the front and back of the check with your smartphone — just select the Front of Check and Back of Check.

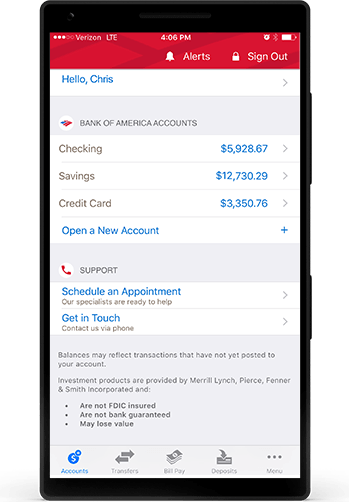

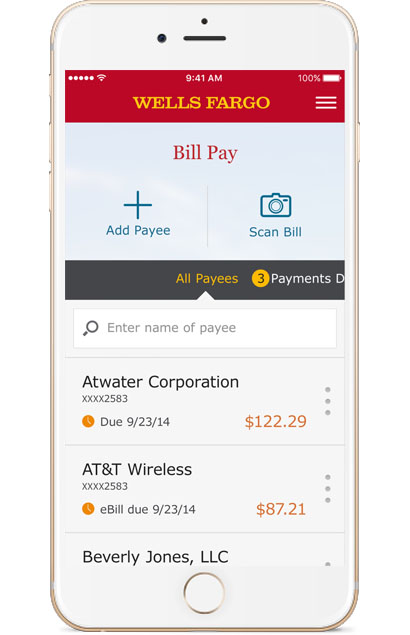

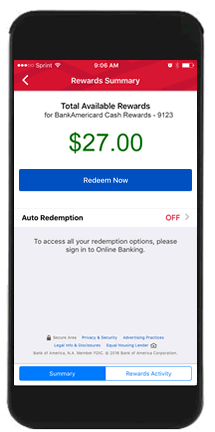

This credit card program is issued and administered by Bank of America, N.A. Deposit products and services are provided by Bank of America, N.A. And affiliated banks, Members FDIC and wholly owned subsidiaries of Bank of America Corporation. Find cutoff and processing times for Mobile Check Deposit, Transfers and Bill Pay. Find out when the funds from a check you deposit become available for your use, when funds you send by transfer are credited and more. Bank of America Credit account (Credit card, charge card, loan, line of credit) 11:59 p.m. ET for same-day credit. The Bank of America mobile check deposit limit are $10,000 per month for accounts opened for 3 months or longer; for accounts opened for fewer than 3 months, the limit is $2,500 per month. The description of the deposit in your account will include the words 'IRS” and TAXEIP” How can I deposit my paper check without visiting a Financial Center? Download our Mobile Banking app. In the app, you can deposit a paper check, using a photo image, and get confirmation immediately that your deposit has been received.

Before snapping photos of her money order with Bank of America’s mobile deposit app, April took the time to make sure that money orders were permitted. She lives 200 miles away from the nearest Bank of America (yes, there is such a place in this country) and can’t go to a branch or ATM to deposit it. The app’s “help” section said that money orders are totally allowed, so she went ahead with the deposit. They rejected it, and customer service told her that money orders can’t be deposited with the mobile app. Well, fine. Maybe she’ll just go ahead and deposit that money order at a bank that’s local to her.

Today, I attempted to deposit a money order via Bank of America Mobile Deposit, after thoroughly checking in the Help section under “Acceptable Items” that Money Orders were, indeed, able to be deposited in this way.

When my clear, well-lit, well-framed photos were returned as “Cannot Be Read” several times, I contact customer support, who informed me that, despite the very clearly worded information available in the app’s Help menu, ONLY checks can be deposited this way, and I would need to travel to a BofA location to deposit my money order.

Now, I moved to Montana from Massachusetts recently and have only kept my 8-year-old Bank of America account despite their lack of locations in this and many neighboring states because I am able to deposit checks via Mobile Deposit. (The nearest ATM or Branch is over 200 miles away.) When I pointed this out to the Customer Service rep and said that these sorts of oversights and misinformation could result in closing my account, she told me they wanted to keep me as a customer but could offer no alternative solutions.

We sent an e-mail to Bank of America’s media contact to see whether they know what the mobile deposit policy on money order is, because the app designers and their own customer service staff clearly don’t agree.

Editor's Note: This article originally appeared on Consumerist.

Point. Click. Deposit. See how easy it is to deposit a check using the MyMerrill Mobile app!

MyMerrill Mobile Check Deposit

Bank Of America Mobile Deposit Money Order

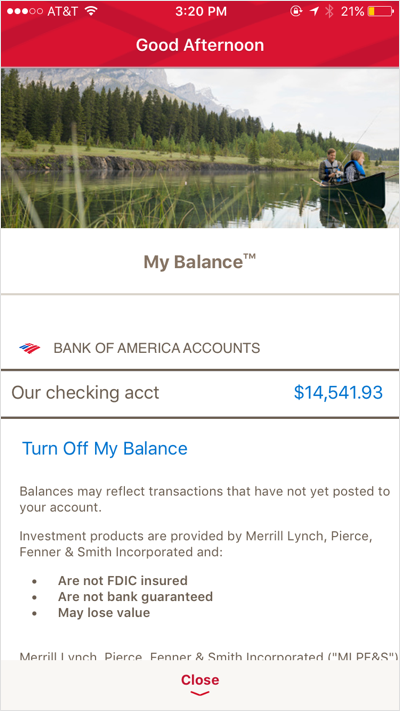

Mobile Check Deposit on the MyMerrill mobile app allows you to securely and conveniently deposit checks anytime and anywhere into eligible Merrill investment accounts.

Once you log into the MyMerrill mobile app:

- Tap on the check deposit icon.

- Using your device’s camera, take a picture of both

sides of the check. - And remember to sign the back.

- Select your deposit to account & enter the

amount. - Tap continue to verify the deposit, and lastly

finally, tap “make deposit” to process therequest.

A confirmation notice will appear on the screen letting you know it the check was accepted.

- You may can check the status of your deposit at

any time by returning to the app,selecting “check deposit” and then “view status.” - Deposits made after 7:30 p.m. Eastern Time will

be processed on the next business day. - It may take up to eight days before you can invest

or withdraw the funds. - The check should be kept for 14 days to ensure

the issuer has honored the payment.

Bank Of America Mobile Deposit Limit

Mobile check deposit provides you a secure and convenient option right from your home!

Important Information:

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S” or “Merrill”) makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (BofA Corp.). MLPF&S is a registered broker-dealer, Member SIPC and a wholly owned subsidiary of BofA Corp.

Investment products:

- Are Not FDIC Insured

- Are Not Bank Guaranteed

- May Lose Value

Bank Of America Mobile Deposit Cut Off Time

Nothing discussed or suggested in these materials should be construed as permission to supersede or circumvent any Bank of America, Merrill Lynch, Pierce, Fenner & Smith Incorporated policies, procedures, rules, and guidelines.

Neither Merrill Lynch nor any of its affiliates or financial advisors provide legal, tax or accounting advice. Clients should be instructed to consult with their legal and/or tax advisors before making any financial decisions.

Bank Of America Mobile Deposit Funds Availability

© 2020 Bank of America Corporation. All rights reserved.